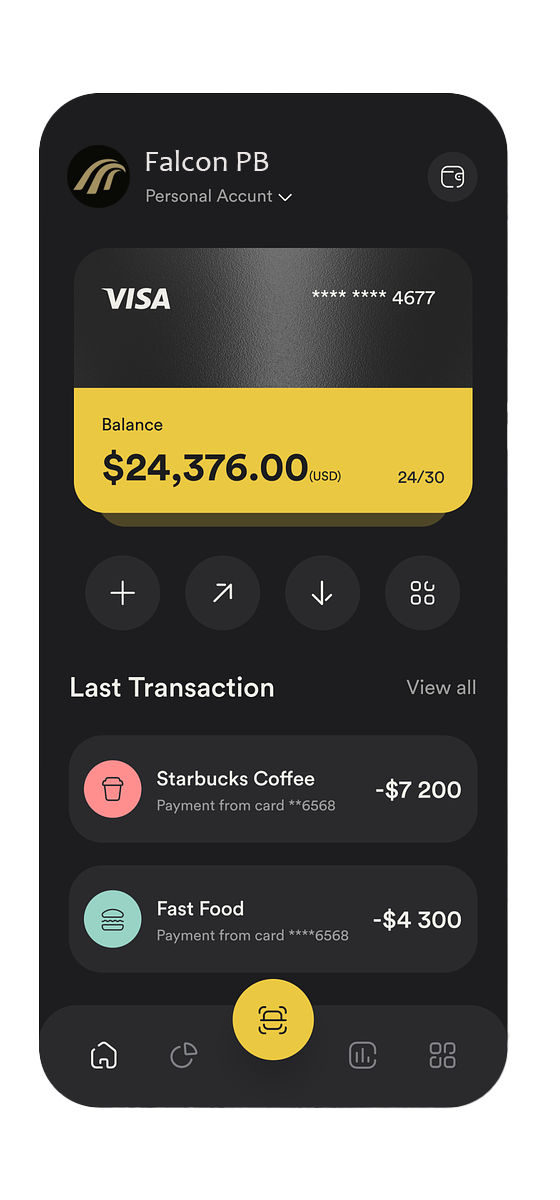

Digitize your financial

Money should be easy. It’s time to say goodbye to banks & financial services companies that don’t work for you

As Featured On:

Statistic

A BUDGET YOU CAN COUNT ON

Control your money now and for the future with smart, simple tools. No sums, no spreadsheets – and no stress.

- Keep count with categories

- Start telling your money where to go

- Take control of your subscriptions

SMART TRACKING

STAY ON TOP OF YOUR SPEND TRENDS

We crunch the numbers, so you can always have an eye on your budget. Get notifications to track your progress or compare your spend over time in-app.

Personalization

Customise it. Personalize it. Make it yours.

Instant linking

Link your virtual card to your Apple or Google Pay wallet to start paying immediately.

Tracking & statistic

Ready to check your balance without The Fear? It’s time to create a budget that actually works.

Safety first

Advanced fraud protection, rigorous security features — your safety is our priority.

Pick a card

Don’t limit yourself to just one card — get two, three, or even more.

Digitize

Why go physical? Because you like the weight of a card in your hand. And for you, getting out cash is king.

END THE OVERSPEND

CHOOSE YOUR PLAN

Change the way you money

Standart

-

This deposit provides an opportunity to earn interest at a rate of 4% on the amount you deposit. Interest is credited to your balance annually at the end of the period or as otherwise agreed with the bank. The depositor earns interest at the rate of 4% of the amount deposited for each year of the deposit term.

Silver

-

This deposit provides a higher interest rate of 6% yearly. As with other deposits, interest accrues on the balance of the deposit annually or as per the terms of the agreement. The depositor receives interest at the rate of 6% of the deposited amount for each year of the deposit term.

Gold

-

This deposit offers even more favorable conditions with an interest rate of 8% yearly. Similar to other deposits, interest accrues annually or as agreed. The depositor receives 8% interest on the deposited amount for each year that the deposit remains active.

International Transfers

SEND MONEY FAR, FAR AWAY

Join our customers worldwide and save on global transfers with Falcon Private Bank. Send money quickly in 25+ currencies to 140+ countries.

FAQ

ask us

anything

What account details are available for me?

All customers registered within the EEA have access to:

- 🇬🇧 GBP local account (sort code and account number)

- 🇪🇺 EUR local account (LT IBAN for domestic transfers within the EEA)

- 🌍 SWIFT account for international transfers in all supported currencies.

If you’re a Dutch customer with an LT IBAN, and your account is migrated to the Dutch branch, you’ll also get access to:

- 🇳🇱 NL local account (NL IBAN for domestic transfers within the EU)

Once you are migrated to the Dutch branch, and you get your NL IBAN, your old LT IBAN will still be active for 12 months to allow you to adapt to all the changes. However, once the period has ended, your LT IBAN will be removed.

If you opened a Falcon PB account after the launch of the Dutch branch, you’ll be provided with NL IBAN and no migration will be required.

How do I change my country of residence?

You can only change your address in-app if your new country of residence is serviced by the same Falcon PB entity as the one with which your account is originally registered.

How do I verify my identity?

Requirements for document:

- Take a clear picture of your identity document, where every single detail is readable and not blurry

- Turn flash off to avoid glare on your documents

- Make sure the details on your Falcon PB profile match the details on your legal document

- Select the correct document type and take pictures of both sides

- Submit pictures of the actual document taken in the moment (live-picture) – we do not accept pictures of a picture, copies, pictures from gallery or scans